Access to capital is one of the biggest barriers small businesses face when looking to implement growth strategies. That’s why it’s important to understand both the advantages and disadvantages of debt financing. A resounding truth in business is that it takes money to make money, but it takes low-cost money to last. And where will that money come from? There are lots of options.

Don’t let the word “debt” scare you. Essentially, debt financing is the act of raising capital by borrowing money from a lender or a bank. In return for a loan, creditors are then owed interest on the money borrowed.

Debt can be cost-effective, providing growing businesses with the funds to stock up on inventory, hire additional employees and purchase real estate or much-needed equipment.

In this post, we’ll go over:

The guide to raising capital

In this guide, we'll share everything you need to know about getting funding to start or grow your business

What is debt financing?

Don’t let the word “debt” scare you. Debt financing is essentially the act of raising capital by borrowing money from a lender or a bank, to be repaid at a future date. In return for a loan, creditors are then owed interest on the money borrowed. Lenders typically require monthly payments, on both short- and long-term schedules.

Debt financing also includes peer-to-peer lending, lines of credit and government-subsidized loans (these loans are usually designed to help small businesses acquire capital with reduced risk—more on that below).

An example of what debt financing looks like

To get a better understanding of debt financing, let’s take a look at the following scenario.

Sarah’s pet store sells supplies, food, equipment and accessories. Business has been steady since she opened five years ago, but for the past year it’s been booming. Lately she’s been thinking about opening another location to expand her business, which would allow her to meet demand and reach more customers.

Sarah has strong cash flow and money saved up to make an investment in her new location, but she estimates she’ll need at least $60,000 to cover basic costs to get it up and running. She decides to go to her bank for a cash-secured business loan. It works out to a five-year, lump-sum loan of $50,000 with a 6.2% fixed interest rate.

Advantages of debt financing

You won’t give up business ownership

One major advantage of debt financing is that you won’t be giving up ownership of the business. When you take out a loan from a financial institution or alternative lender, you’re obligated to make the payments on time for the life of the loan, that’s it. In contrast, if you give up equity in the form of stock in exchange for funding, you might find yourself unhappy about input from outside parties regarding the future of your business.

There are tax deductions

A strong advantage of debt financing is the tax deductions. Classified as a business expense, the principal and interest payment on that debt may be deducted from your business income taxes.

Pro tip: always check with a tax professional or other financial planner to help answer specific questions about how debt affects your taxes.

Low interest rates are available

Credit cards, peer-to-peer lending, short-term loans, and other debt financing isn’t helpful if the interest rates are sky-high. However, there is good news. A Small Business Administration (SBA) loan is a great option for low-cost funds.

With long terms and low rates, an SBA loan is the gold standard for low-cost financing. If you don’t qualify for an SBA loan, there are plenty of other options out there. Just be mindful of the true cost of that loan. Work with a lender who practices complete transparency so you don’t get trapped in a cycle of borrowing. Understand your total payment, both interest and amortization. A good rule of thumb is if you typically have more than one payment per month or if the payment calculation is overly complicated, beware and take care not to move forward.

SBA loans are great options for business owners who are looking to expand to more than one location, as most of the time these loans require you to be in business for at least one or more years. That paired with strong credit can help you secure an SBA loan at a lower interest rate.

You’ll establish and build business credit

According to Investopedia, one of the primary reasons why small businesses fail is a lack of funding or working capital. Stellar business credit is crucial if you’re seeking low-cost, long-term debt funding. Therefore, having the ability to build your business credit is a major and crucial advantage to taking out a loan. When you build your small business’ credit, you reduce the need to rely on your personal credit or other high-cost business financing options. Good business credit can also help you establish more favorable terms with vendors.

For established businesses looking to expand and open new locations, strong business credit will provide the credibility lenders look for when approving a loan application.

Debt can fuel growth

Uses of long-term debt include opening new store locations, buying inventory or equipment, hiring new workers and increasing marketing. Taking out a low-interest, long-term loan can give your company working capital needed to keep running smoothly and profitably year round. Think of it as the difference of being able to go that extra mile in your business and make additional profits, opposed to being tied down to a cash-strapped venture that will never be able to get ahead.

Debt financing can save a small business big money

Often, small business owners rely on expensive debt, like credit cards, cash advances or lines of credit, to get their business off the ground. This type of debt cuts into cash flow and can hinder day-to-day operations. A big advantage of debt financing is the ability to pay off high-cost debt, reducing monthly payments by hundreds or even thousands of dollars. Reducing your cost of capital boosts business cash flow.

Long-term debt can eliminate reliance on expensive debt

There are lenders who use aggressive sales tactics to get businesses to take out short-term cash advances. This strategy can trap a borrower into a debt cycle with no end in sight. Although cash advances do have their own benefits, they may not be right for every business. An alternative is an SBA loan. SBA loans have low interest rates, long terms, and low monthly payments. SBA loans can be used to help free small business owners from borrowing traps.

Bigger businesses can benefit from debt refinancing

Debt refinancing is useful for businesses that already have debt, and want to renegotiate the terms to make them more favorable. Essentially, you take out a new loan to repay your existing debt, allowing you to update your lending agreement to something that works better for you. You can get a lower interest rate this way and even improve your credit score.

Let’s take a look at Sarah’s scenario again to get a better idea of debt refinancing. Let’s say when she first started her business, she borrowed $80,000 from her bank, plus 7.4% interest. She’s been paying her original debt monthly ever since, but it hasn’t been paid in full yet. Keeping the fact that she’s opening a new business location in mind, she decides to refinance her debt instead of taking out a brand-new loan. This way, she can pay the rest of her original debt and negotiate a lower interest rate and better terms while she’s at it.

Watch our demo to find out how Lightspeed Retail empowers retailers.Starting a business? See what Lightspeed can do for you

The disadvantages of debt financing

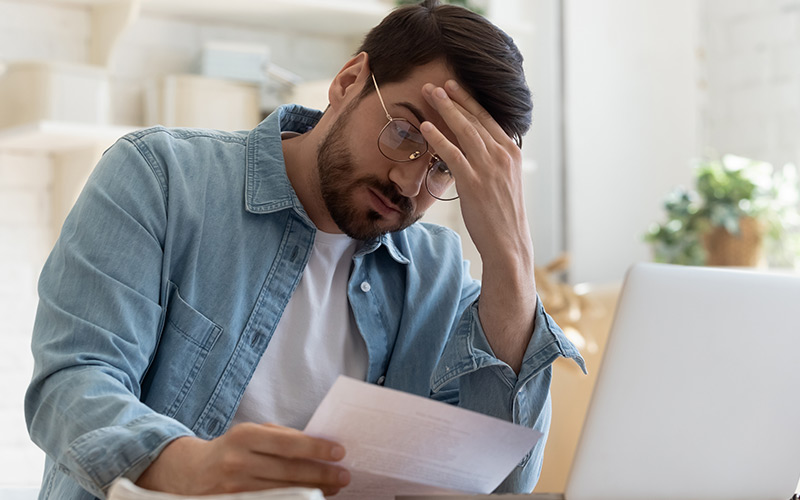

You must repay the lender (even if your business goes bust)

When you work with a lender, the rules are pretty clear. You must pay back the loan at the terms agreed upon. That means, even if your business goes under, you still have to make payments. Since most lenders require you to guarantee the loan, your assets could be sold to satisfy your debt.

Qualifying can be difficult

Eligibility requirements vary among lenders, but generally you need to have a strong credit history, meet a revenue threshold, and be operational for a minimum number of years. Consider all your debt financing options to figure out what’s best for your business so you don’t have to waste time applying for capital that you may not meet the requirements for.

High rates

Unfortunately, predatory lenders exist and the techniques they use to rope in unsuspecting small business owners are getting more and more sophisticated. It’s definitely not unique to debt financing, but it is something to be aware of. Instead of disclosing the true cost of a loan, some unscrupulous lenders will use methods other than APR. Make sure you are working with a lender who practices transparency and will give you honest numbers. Know both your loan APR and your loan payment and compare it to your original balance.

It impacts your credit rating

Each loan you take out for your small business will be noted on your credit rating. Beware, this can cause your scores to drop. So before you apply for a loan, check with your lender to determine if the credit check performed to prequalify will affect your score.

You’ll need collateral

One of the “5 Cs” of lending is collateral. The SBA defines collateral as an additional form of security that can be used to assure a lender that you have a second source of loan repayment. If an asset can be sold by the bank for cash, it’s considered collateral. Items like equipment, buildings and (in some cases) inventory qualify. Collateral reduces the risk to a lender and is required for many types of loans. The amount of collateral a borrower has to put up is usually related to the size of the loan. Often, this is seen as a negative by some borrowers.

Need funding for your business?

If you’ve decided that extra funds can take your business to the next level, it’s important to examine the advantages of debt financing. Remember that all debt is not created equal. So, strive to maintain strong credit scores so that you can get the lowest APR and the longest terms—ultimately, ensuring the health and longevity of your business.

Are you a Lightspeed (and Lightspeed Payments) customer that’s in need of funding? If so, visit our website to learn more about Lightspeed Capital.

If you want to get started with Lightspeed, talk to an expert today about our point-of-sale offering.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.