Accounting is crucial to the health of any business. Keeping track of your financial information allows you to make better business decisions, no matter the approach you use. That’s why for retailers—especially those that are in the process of scaling—it’s worth getting up to speed on retail methods of accounting.

While retail accounting isn’t a separate discipline of accounting, the difference is that there’s a greater focus on inventory, which we’ll explain in this guide.

In an uncertain economic climate, it’s important to understand all the accounting options at your disposal. This article will guide you through the retail accounting method and hopefully help you decide if this method is right for your business.

Here’s what we’ll cover:

- What retail accounting is (in simple terms)

- How retail accounting manages inventory costs

- The retail accounting method formula

- A quick example of the retail accounting method

- The advantages of the retail accounting method

- The disadvantages of the retail accounting method

- How to decide if retail accounting is right for you

- Alternatives to retail accounting

Keep track of your stock, purchases and sales with our handy inventory spreadsheet.Need help managing inventory?

What is retail accounting?

At its most basic, retail accounting counts the cost of inventory relative to the selling price.

In fact, calling it retail accounting makes it sound as if there is a special discipline of accounting, especially for retailers.

There isn’t really.

When you hear retail accounting, keep inventory in mind—because this is really what it’s all about.

In other words, retail accounting is a way of tracking inventory costs that is especially simplified compared to the other available methods.

Retail accounting software can provide a comprehensive account inventory at the item’s retail price in order to detect losses, damages and theft of stock. This helps business owners to track the cost of sales (COS), also known as Cost of Goods Sold (COGS).

The retail method can also help you keep account of the goods you’re buying or selling, know how much is left over, and maintain the right amount of inventory at all times.

“[Retail accounting] is not always appropriate for companies, but when it is it can make accounting much simpler,” says Montreal-based CPA Abir Syed of UpCounting.

“The basic premise is that you assume a consistent margin across everything you sell, and then apply that figure to the retail value of all your inventory to calculate the cost.”

Managing inventory costs with retail accounting

Zach Reece, an Atlanta-based CPA and COO of Atlanta roofing company Colony Roofers, says there are plenty of different methods available for managing inventory, such as First In First Out (FIFO), Last In First Out (LIFO), Specific Identification, and Weighted Average.

“FIFO is great for perishable things like groceries, says Zach. “LIFO is great for stuff like concrete where the inventory isn’t easily distinguishable. Specific identification is useful for big-ticket stuff that moves slowly. Weighted average is good for something like lumber, which is non-perishable and individual but indistinguishable. Your acquisition costs will vary even if the price stays the same.”

You can read more about inventory costing in this dedicated guide.

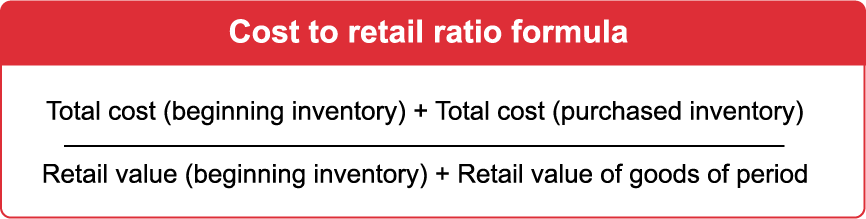

Retail method accounting formula

With the retail method, you total up the total costs of inventory and the total value of goods for sale, and then divide costs into retail value.

Here’s what that looks like:

“Due to the simplicity of the calculation, it requires far less tracking to perform the calculation. That means that a company doesn’t need a sophisticated accounting system to calculate their inventory costs, “ said Abir.

Example of the retail method of accounting

That’s the formula. What would this look like in practice? Here’s an example from Abir:

Let’s say someone sold tables and chairs. They sell the tables for $400 each and chairs for $200 each and they’re both sold at a 40% markup from the purchasing price. A table costs $160 each, while a chair costs $80.

For this example, let’s say you have 10 tables and 5 chairs in beginning inventory and you purchased an additional 5 tables and 6 chairs mid-month.

Total cost (beginning inventory)

Total cost (beginning inventory) = (10 x 160) + (5 x 80)

Total cost (beginning inventory) = (1,600) + (400)

Total cost (beginning inventory) = $2,000

Total cost (purchased inventory)

Total cost (purchased inventory) = (5 x 160) + (6 x 80)

Total cost (purchased inventory) = (800) + (480)

Total cost (purchased inventory) = $1,280

Retail value (beginning inventory)

Retail value (beginning inventory) = (10 x 400) + (5 x 200)

Retail value (beginning inventory) = 4,000 + 1,000

Retail value (beginning inventory) = $5,000

Retail value of goods of period

Retail value of goods of period = 5,000 + (5 x 400) + (6 x 200)

Retail value of goods of period = 5,000 + (2,000) + (1,200)

Retail value of goods of period = 5,000 + (3,200)

Retail value of goods of period = $8,200

Now, that we’ve solved for the values we need, we can use the retail method of accounting to find our cost to retail ratio:

Cost of retail ratio formula = 2,000 + 1,280 / 5,000 + 8,200

Cost of retail ratio formula = 3,280 / 13,200

Cost of retail ratio formula = 0.24

The cost to retail ratio for this month’s table and chair inventory is 24%.

The advantages of the retail method of accounting

Given some of the limitations of the retail accounting method, you might be wondering why it is used. “The advantage is that it’s very easy to calculate and doesn’t require sophisticated tracking of how much someone paid for each SKU they purchased from a supplier,” says Abir.

Although it should be something you do consistently, you don’t have to count your inventory or run inventory reports to use this method, meaning you can get a sense of your inventory’s value based on a small set of numbers. That’s a bonus for retailers, who might be worried about having to pay staff to do stock checks while keeping the doors closed.

The retail method of accounting can be helpful for multi-location retailers because it allows for fast, consistent inventory tracking. That helps with organization and provides a holistic view of inventory across all locations, saving time and money.

The disadvantages of the retail method of accounting

But depending on the needs of your business, the drawbacks may outweigh the speed and ease of the retail method.

“This isn’t a good method if your pricing changes frequently due to things like sales [promotions],” says Abir, “or if your different SKUs have different margins, or if your costs for a given SKU changes over time. The reason it can often work in retail is that retailers will often ensure a consistent margin across all their SKUs, and their costs from wholesalers don’t fluctuate too much.”

It only provides an estimate

Another problem? It’s mostly a guess. “The disadvantage is that it’s not especially accurate, and is only acceptable as an inventory costing method in circumstances where it does a good job of estimating the actual cost,” says Abir.

It’s not suited to variable markups

“Retail accounting is constrained because it’s an estimate. You need more accurate methods to use in conjunction. It’s also predicated on a consistent markup, which doesn’t work well if you have sales [promotions] or radical differences in markup between products,” says Zach.

Is the retail method right for you?

It depends. If you’re selling on multiple channels or operate more than one brick-and-mortar location, your books are likely to become increasingly complex. That’s when the convenience of retail accounting comes in handy: you won’t have to conduct physical inventories as frequently, which could also help lower overall costs.

However, a downside to this is that the retail method can be limiting in terms of accuracy and flexibility.

“Price and markup changes make retail accounting much less accurate, and many industries are dealing with those right now. More accurate methods are going to be important,” says Reece.

If you value convenience and simplicity for business accounting, the retail method may work well for you. Keep its limitations in mind, though: when it comes to discounted items, sales or markups, the retail method doesn’t account for those.

Weigh those pros and cons to decide whether the retail method is right for you.

Alternatives to retail accounting

As we discussed earlier, the retail method of accounting shouldn’t be viewed as its own discipline. However, it’s handy to compare it to commonly used forms of accounting. These tend to be used in conjunction with one another because they each provide a different approach to categorizing financial information.

Cost accounting

This method is used by a company’s internal team to make informed decisions about business operations. Cost accounting involves assigning and breaking down a business’ fixed and variable costs to determine where money is being spent, where it can be saved, and how to optimize and increase profit based on costs.

Cost accounting is useful for making internal business decisions that improve a company’s production process, especially for larger businesses with more expenses.

Financial accounting

Financial accounting involves the reporting, analyzing and outlining all of a company’s transactions (daily, weekly and monthly) in financial statements. These statements are often prepared for external use, to show the public —including investors, tax institutions, the government and banks—the financial health and performance of the company.

All businesses use some form of financial accounting, as these statements serve a purpose both internally and externally, providing detailed data on all business transactions.

Managerial accounting

Managerial accounting is crucial for understanding the operations of a business. Financial information and data (often sensitive) are gathered, then presented to business managers so they can better oversee internal business processes.

Managerial accounting is important for implementing strategies to optimize growth and profitability for a company. The data produced through managerial accounting is never used for external purposes.

Stay on top of bookkeeping with accounting solutions

If you’re a retailer, you likely use at least a couple of the methods we’ve discussed in this article. The retail method of accounting in particular is simple, convenient, and can save you time in the long run, but it’s not without drawbacks.

As your business grows, keep in mind that your accounting processes will evolve with it. With Lightspeed Retail, you can get integrated accounting software that simplifies bookkeeping and automates processes to help your business run smoother than ever. Talk to an expert today to get more information.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.