Unified payment & POS platform

Fast and secure payments, built into your POS

Lightspeed Payments is made for ambitious retailers. Process sales, get paid and streamline your business from one unified platform.

Lightspeed powers leading businesses in over 100 countries.

$87.1B

Lightspeed’s customers processed $87.1 billion in GTV* through Lightspeed’s platform in fiscal 2023

~168K

~168K locations around the world trust Lightspeed**

Drive efficiency across your business with one solution.

Get paid quickly with Lightspeed Payments, no matter where customers shop.

Get up and running fast with our intuitive, in-depth setup process

Unify your operations with payments hardware, software and customer support in one place

Personalize the customer experience using insights from payment data

Identify top revenue streams with a full view of multilocation and multichannel sales

Cost-effective and transparent payment processing fees

Processing fees are always simple and predictable, so you can accept payments with confidence.

- Save money with simple pricing

- No hidden fees or markups

- Negotiate a competitive rate

- Free chargeback assistance

Enjoy free, 24/7 support.

Whether it's hardware or software, getting set up is easy with Lightspeed Payments. Have our experts walk you through the process step by step.

- Get transactional fast with a plug-and-play setup

- Take advantage of personalized one-on-one software training

- Gain long-term success with dedicated support from industry experts

- Access detailed resources like guides, videos and more

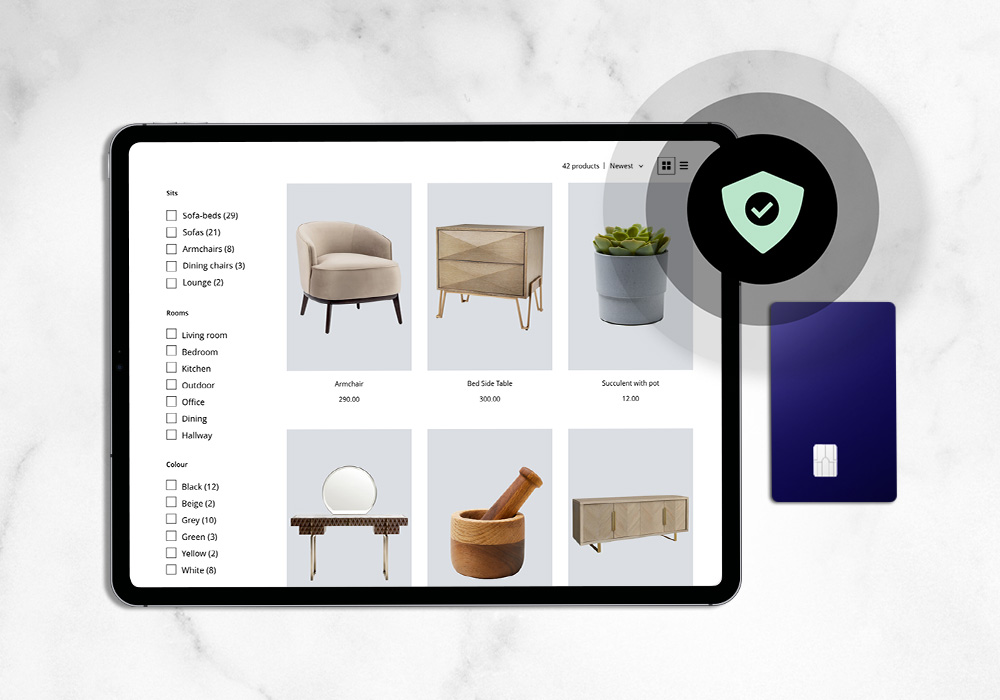

Accept any payment, anytime.

Lightspeed Payments provides leading terminals and equipment, so you can accept any mobile payment with ease.

- Accept payments from all major credit and debit cards, Apple Pay and Google Pay

- Enjoy increased mobility to accept payments anywhere in-store or curbside

- Help drive revenue with tipping functionality and other built-in features

- Keep things simple with an easy-to-use interface that's staff and customer-friendly

Premium security comes standard.

Security is our top priority. Lightspeed Payments comes with premium security features built-in, so you'll have peace of mind from day one.

- Protect their data with PCI DSS validated Level 1 Service compliance

- Secure your data with end-to-end encryption for all transactions, in-store and online

- Get 24/7 server security monitoring by our in-house team

All the answers you're looking for.

Does Lightspeed offer a complete solution?

Lightspeed proudly offers a 360° unified solution. Having only one provider for your point of sale technology, payment services, hardware and support team saves you countless time and money. Plus, it makes running your business so much easier.

I currently have a contract with another payment provider. How can I switch?

Depending on which provider you currently have a contract with and what your terms are, the cancellations fees they impose will differ. Thankfully, the switch process to Lightspeed Payments is smooth sailing. Our friendly support agents take you from start to finish and make sure you’re running without a hitch before you go live.

Is hardware included?

Lightspeed hardware is sold separately. For security purposes, you cannot use any existing terminal hardware you might already have as these have not been injected with the certified firmware. Safety first!

What is the average deposit time for funds?

You can expect to see money deposited into your account within 2 business days after a transaction is made. Please note, that a number of circumstances may affect this timeline, including delays caused by bank systems or risk monitoring. For further details on when to expect your funds, please refer to our documentation on getting paid.

Are there hidden fees?

Never. With Lightspeed you’ll never find a complicated or cryptic fee on your statement. The only thing you can expect is a $15 chargeback fee, should one even occur at all. We offer competitive rates and our experts are happy to tailor the right solution to fit your business. No monkey business here.

What happens if I get a chargeback?

Sadly, chargebacks can happen and they are a reality no retailer can escape. Luckily, we make it so much easier for you to deal with. You will be charged a single $15 fee and we will fight tooth and nail to dispute the claim on your behalf. We’ll assist you from start to finish and keep you updated on the status as the dispute progresses.

Where can I find all my payment related reports?

Your transaction and settlement reports are all in your Lightspeed POS, in the same place you run all your other standard reports from. Your deposits and batches are tracked in real-time, which makes reconciliation much faster and easier.

Can I use Lightspeed Payments for my Lightspeed eCom store?

Absolutely. In fact, you really should. It’ll save you lots of time, headaches, and money. The second you turn on Lightspeed Payments, you instantly have both in-store and online processing. It’s that simple.

What card types can I accept with Lightspeed Payments?

Lightspeed Payments accepts all major credit and debit cards. And the rate is always the same no matter what card your customer chooses to pay with. No surprises.

What are embedded vs. non-embedded payments?

"Lightspeed Payments is an embedded payment processor, meaning it communicates with Lightspeed POS to process payments. Transactions are automatically recorded in your POS system, saving time and reducing errors because it eliminates the need for manual entry. Embedded payments make for a better checkout experience for both your employees and customers. Plus, you have access to plenty of valuable info including batch settlements, reports and customer data.

With non-embedded payments, processors don't communicate with the POS system. Transaction data isn't recorded—you have to manually input information, making the checkout process more complex. "

More questions?

Did we miss anything? Give us a call or send us an email to keep the conversation going.

-

For the fiscal year ended March 31, 2023, Lightspeed’s customers processed $87.1 billion in GTV through Lightspeed’s platform. "Gross Transaction Volume" or "GTV" means the total dollar value of transactions processed through Lightspeed’s cloud-based software-as-a-service platform, excluding amounts processed through the NuORDER solution, in the period, net of refunds, inclusive of shipping and handling, duty and value-added taxes. GTV does not represent revenue earned by Lightspeed. GTV excludes amounts processed through the NuORDER solution because they represent business-to-business volume rather than business-to-consumer volume and Lightspeed does not currently have a robust payments solution for business-to-business volume. *See the section entitled “Key Performance Indicators” in Lightspeed’s most recent MD&A available on our investor relations website and at www.sedar.com and www.sec.gov for more details.

-

Customer Locations as at March 31, 2023, excluding impact of Ecwid ecommerce standalone product. Customer Locations means a billing merchant location for which the term of services have not ended, or with which we are negotiating a renewal contract, and, in the case of NuORDER, a brand with a direct or indirect paid subscription for which the terms of services have not ended or in respect of which we are negotiating a subscription renewal. A single unique customer can have multiple Customer Locations including physical and eCommerce sites and in the case of NuORDER, multiple subscriptions. See the section entitled “Key Performance Indicators” in Lightspeed’s most recent MD&A available on our investor relations website and at www.sedar.com and www.sec.gov for more details.